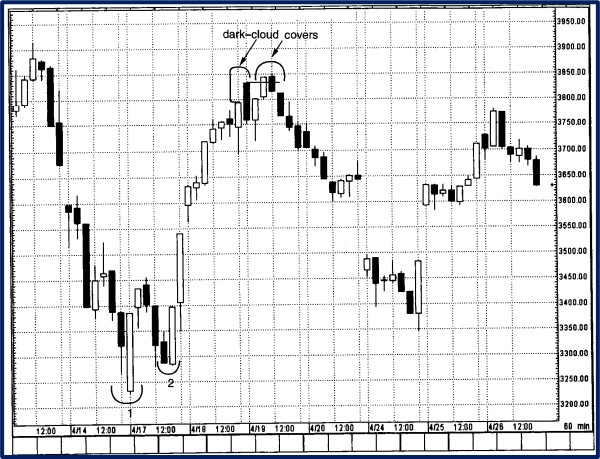

The pattern successfully predicted a downturn in the following session where the price moved nearly seven percent lower. When you spot the Dark Cloud Cover pattern on a Japanese candlestick chart, expect a potential bearish reversal. As investors sell to take profits and others continue to sell for fear of losing them in the downturn, the stock price corrects significantly. How significant is unknown until buyers feel confident enough to step in and create support. For example, in the chart below, we see that the Apple stock has been in a bullish trend.

In this article, we’ve shown you how you can work with the pattern to improve its accuracy. We’ve also had a look at some strategy examples that use the dark cloud cover pattern. Candlestick charts have come to attract many traders since their introduction to the western world in the late ’80s. There are many candlesticks to choose from, and all have their distinct meaning and character. The topic for this article is the dark cloud cover, which is one of the most widely known and used candlestick patterns. In technical analysis, the Dark Cloud Cover serves as a potential indicator of an impending bearish reversal.

- Our watch lists and alert signals are great for your trading education and learning experience.

- This pattern serves as a robust entry trigger, shedding light on the ongoing struggle between bulls and bears at key areas on the chart.

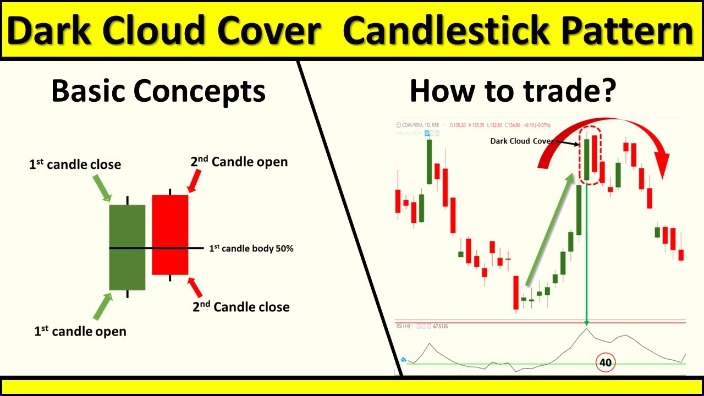

- The dark cloud cover candlestick pattern involves just two candles and acts as the opposite of the piercing pattern.

- At the resistance level, the price forms an inverted Hammer, indicating some rejection.

In the chart below, the pattern is marked with the letter D and a small arrow, which makes it easier for anyone to detect the pattern formation in the chart. A small red bearish candle is formed after a green bullish candle, providing a hint of down move. Next, the possibility is confirmed because, after that, a big red bearish candle appears. The dark cloud cover is a bearish reversal pattern that occurs after a downtrend.

RSI analyzes the strength of an asset’s price motion and helps traders spot overbought or oversold market conditions. The RSI in the overbought range and the Dark Cloud Cover pattern confirm the market’s impending bearish reversal. The price is predicted to decline after a Dark Cloud Cover candlestick pattern, and traders place a short position in the market. This indicates that they want to sell the asset in the hopes of repurchasing it at a reduced price in the future and generating a profit. They may also employ additional risk management approaches, such as position sizing and diversification.

© 2023 by Bullish Bears LLC.

The term ideally means that the tumbling prices resemble dark clouds. Before going into the depth of a bearish dark cloud cover, it is important to understand some concepts, which are also the basic requirements for the dark cover to occur. In this part of the article, we wanted to share a couple of trading strategy examples that use the dark cloud cover pattern. With the first approach, you want to make sure that the dark cloud cover was formed with significantly more volume than the preceding bars in the uptrend. Another conclusion we could draw is that the market now has had a major volume blow off, which traditionally is a sign of a coming reversal. Traders can develop trading strategies around this pattern by setting entry points, stop-loss orders, and exit points.

How to Trade Dark Cloud Cover Pattern

This gap indicates that the residual buying pressure from the previous day’s close encourages more buyers to buy the stock at the beginning of the day. But later in the day, the sellers start selling off their stocks, thus pushing the price downwards. This gap gives the bearish candle a higher position than the bullish candle. Dark Cloud Cover is a bearish reversal candlestick pattern appearing in an uptrend.

Look at the Size of the Candles

We can see the dark cloud cover pattern occurring on the Microsoft (MSFT) daily chart on February 11th, 2020. The Dark Cloud Cover pattern is the opposite of the Piercing pattern (which is a bullish reversal candlestick). This candlestick pattern is easy to identify because its formation dark cloud cover pattern reflects its name. These criteria are important because they show, specifically, the power struggle between bulls and bears and the transition from bullish to bearish outlook in the stock’s price.

- Dark Cloud Cover is a bearish candlestick reversal pattern, similar to the Bearish Engulfing Pattern.

- While the Dark Cloud Cover is a valuable tool, it can produce false signals.

- Traders should be aware of the potential for false signals, the pattern’s lack of effectiveness in volatile markets, and its status as a lagging indicator for best results.

- In the chart below, the pattern is marked with the letter D and a small arrow, which makes it easier for anyone to detect the pattern formation in the chart.

- Another scenario in trending markets happens when price is already in a significant downtrend and experiences a brief pullback.

- A dark cloud cover pattern is stronger if the candle closes below the low of the confirmation candle; from there, the price can decrease.

Forex trading involves significant risk of loss and is not suitable for all investors. The Dark Cloud Cover pattern can be summarized by imagining a dark cloud overtaking the sky on a bright, sunny day. The fact that this candle opens higher, but erases more than half of the previous candle’s gain, is what gives it a bearish character and also its name. Alternatively, you can place the target level at the recent areas of resistance/support.

Traders use specific steps to identify the Dark Cloud Cover candlestick pattern in technical analysis. Traders first look for an uptrend in the market to spot the pattern. They examine the first candle then, which should be a long bullish candle indicating buying pressure.

Dark cloud cover in investing is a bearish reversal candlestick pattern. Here, a down candle opens above the prior up candle’s close and closes below the midpoint of the up candle. It is often followed by another down candle, which shows a downtrend confirmation. The Dark Cloud Cover pattern provides traders with an opportunity for profit.

The Dark Cloud Cover pattern serves as a warning sign to traders, indicating a possible exhaustion of the bullish trend and the start of a bearish reversal. A higher trading volume on the second day of the Dark Cloud Cover pattern can indicate stronger selling pressure, supporting the bearish reversal signal. On the first day of the pattern’s formation, the bullish sentiment is confirmed with a strong bullish candle. The candle’s body, the difference between the open and close prices, is long, signifying a significant price increase during the day.

The Dark Cloud Cover pattern may appear less frequently in stable and trending markets, as strong trends tend to last for a long time before reversing. Despite the fact that both the Dark Cloud Cover and Bearish Engulfing candlestick patterns are bearish reversal patterns, there are significant variations between them. The Dark Cloud Cover pattern happens when a bullish candle is followed by a bearish candle that starts above the high of the previous candle but closes below its middle. The Bearish Engulfing pattern happens when a small bullish candle is followed by a larger bearish candle that totally engulfs the previous bullish candle. The Bearish Engulfing pattern is regarded as a stronger reversal indicator.

Closing of the Second Day Candle Within the Body of the First Day’s Candle

In order to enter a trade, we require that the 14 – period ADX is above 20, which indicates a strong trend. Some markets have special days of the week or periods of the month that are better than others. If you explore these tendencies, you could take that into account as part of your analysis. As such, if a market is trending up and covers a greater distance with each bar that passes, we might want to be careful.