It would be best to keep a digital copy just in case a hard copy gets damaged or lost. Having a digital copy on a Cloud-based technology allows for nearly unlimited storage and access to information from almost anywhere. For those who love hard work, spending time outside, and being your own boss, starting a landscaping business may be https://www.merchantcircle.com/blogs/raheemhanan-deltona-fl/2024/12/How-Construction-Bookkeeping-Services-Can-Streamline-Your-Projects/2874359 a great fit.

How does the Percentage of Completion Method work?

A balance sheet is an overview of a company’s finances, including assets, liabilities, and equity. One potential downside of the accrual method is that businesses can pay income tax on unrealized profit since the accounting system can record revenues that have not yet been received. One way to mitigate this problem is to structure contracts with the profit evenly distributed rather than front-loaded.

Flex Time vs. Comp Time: What’s the Difference and Which Is Right for You?

Implement a monthly reconciliation process you can lean on to keep these ghost transactions at bay. I see a lot of contractors tempted to add every little accounting code to their Chart of Accounts, but it’s really not designed for that level of detail. Instead, categorize the financial information in your COA into buckets like labor costs materials, subcontractors, etc. By keeping it simple, you won’t have to scroll several pages down on your P&L to get meaningful information. The thing is, whatever doesn’t hit your P&L (for example, the principal part of a loan payment), goes on your balance sheet.

Tip 1: Record all details about payments and invoices

Manual reporting methods are time-consuming and prone to errors, resulting in inaccurate data. In the construction industry, understanding the financial position of each job can be key to a company’s success. Job profitability reports provide a clear view of a project’s financial performance,… The quick ratio measures whether a company can pay its current liabilities with cash or assets that can quickly be converted to cash.

- Contractor invoices provide a written record of any payment disagreements and you can use them in dispute resolution if necessary.

- If you’re not clear on what revenue recognition for tax purposes should look like for your company, check out this guide.

- Construction accounting is a specialized type of accounting that focuses on the unique aspects of construction projects.

- For one, there’s a large variety of financial transactions in the construction industry.

- However, all three sections are related, as total assets are equivalent to the sum of liabilities and equity.

- Importantly, the income sheet’s view of profit must match the change in equity reflected on the balance sheet.

Complete contract method

- Additionally, while a non-certified accountant could handle some of your bookkeeping needs, you should focus on certified and licensed accountants to stay on the safe side.

- Properly managing and allocating overhead expenses is crucial for contractors, as it directly impacts the company’s profitability and long-term financial stability.

- The problem is, construction is so complex that you need at least a bit of background knowledge on how to navigate the bookkeeping process.

- It often feels so much easier to drop a bag full of receipts on a CPA’s desk at the end of a job and pay them to sort it out.

- Boost your financial leadership skills with our upcoming webinar for AGC members, which shares how construction leaders can turbo-charge their accounting department!

The purpose of the Act is to protect local wages from being undercut by out-of-area contractors and construction workers. The Davis-Bacon Act applies to all construction projects under government contracts, including road construction, building construction, renovations, new construction, and painting. To help you better identify what kind of accounting software will help you simplify your financial efforts and streamline your business processes, we’ve prepared a handy comparison list.

Utilize software

- Ideal debt-to-equity for most companies is between 1 and 2, and companies with a debt-to-equity ratio higher than 2 may be unable to pay off its debts.

- Construction professionals working with outside accountants can also benefit from the CPA Audit and Review Software, which automatically shares data with CPAs to ensure ongoing financial compliance.

- Essentially, this ASU improves disclosure requirements, prompting more useful information out of financial statements.

- The percentage of completion method (PCM) is a method of accounting that records revenue when it has been earned but not yet received.

- On top of that, construction contracts often include retainage — a portion of the payment that is withheld until the entire project is complete.

- Make sure to take advantage of these free trials when you’re shopping for your next bookkeeping solution.

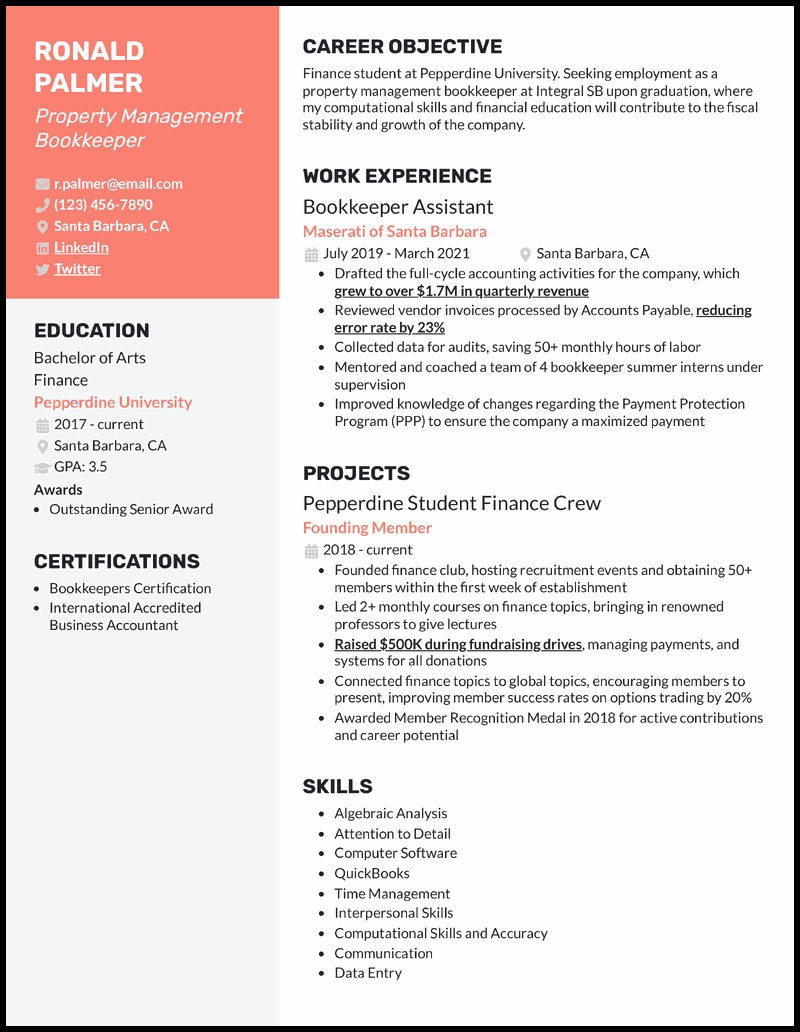

Forming solid construction accounting processes is absolutely critical if you want to grow your contracting business. The problem is, construction accounting is entirely different from accounting in other industries. From long term contracts and historically slow pay cycles to balancing costs in dynamic and unpredictable site conditions, there are a ton of factors that make financial management much more difficult.

Tip 5: Use milestone payments

Even somewhat repeatable projects require modifications due to site conditions and other factors. Essentially, this ASU improves disclosure requirements, prompting more useful information out of financial statements. The FASB put it in place to ensure companies provide more transparency into how they recognize their revenues. This method is beneficial for ongoing projects that require tracking individual stages of work. It’s helpful when you need to How to Use Construction Bookkeeping Practices to Achieve Business Growth keep an accurate record of your progress and give stakeholders an idea of what to expect in the future.

Accrual method

Any bookkeeping solution you choose should have these core features at a minimum. If your business has any unique bookkeeping needs, you’ll want to look for a solution that caters to those needs as well. You could have one account reserved for paying expenses, another one for managing payroll, and a third one for receiving payments for clients. Whether you decide to do job costing manually or using software, the same steps apply. Contract retainage, which is the amount of money that customers can withhold until they are satisfied with a project, is typically 5-10% of a contract’s value.